Income Tax Drawings

Income Tax Drawings - In most cases, the taxes on an owner’s draw are not due from the business, but instead the income is reported on the owner's personal tax return. It's a way for them to pay themselves instead of taking a salary. Citizens or resident aliens for the entire tax year for which they're inquiring. However, you will be able to take a deduction for half of the fica tax you pay. But is your current approach the best one? In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. Bring these items with you: Drawings is money you borrow from the company. Web if the amount on line 5 is $100,000 or more, use the tax computation worksheet 14. Arizona has been one of the fastest growing states in recent years, as low taxes may have played a role in drawing people to the desert. Web to figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. Web in a sole trader or partnership structure, money taken from the business throughout the year is called drawings and is simply a distribution of the entity’s expected overall profit. In most cases, the taxes on an. Avoiding unrelated business income tax;. The company pays tax on it's net profit after it's paid you a shareholder salary. You’ll need to use the information from your income tax schedule c form from the previous year. Any tax documents you’ll need. Citizens or resident aliens for the entire tax year for which they're inquiring. In most cases, the taxes on an owner’s draw are not due from the business, but instead the income is reported on the owner's personal tax return. Web the seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Journal entry for income tax in case of a sole proprietorship contains 2. Web prepare for your appointment. Avoiding unrelated business income tax;. The company pays tax on it's net profit after it's paid you a shareholder salary. However, you will be able to take a deduction for half of the fica tax you pay. Web do you have to pay taxes on owner’s draw? Web the seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. You’ll need to use the information from your income tax schedule c form from the previous year. Web do you have to pay taxes on owner’s draw? Web the federal government uses a progressive tax system, which means how much. The company pays tax on it's net profit after it's paid you a shareholder salary. View a gallery of tax cartoons, including cartoons on income taxes, the irs, tax day, and other funny cartoons about paying taxes. Learn more salary method vs. Drawing of the income tax stock illustrations An owner’s draw is not taxable on the business’s income. Web the seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Web do you have to pay taxes on owner’s draw? If the amount on line 1 is less than $100,000, use the tax table to figure the tax. Web november 19, 2021 if you're the owner of a company, you’re. Call to schedule your appointment ahead of time. A taxpayer identification number, such as a social security number. Web the seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows; Its highest tax rate is 12.3%,. You’ll need to use the information from your income tax schedule c form from the previous year. Web federal tax brackets: Web november 19, 2021 if you're the owner of a company, you’re probably getting paid somehow. Web for information on an award you received from a foreign source, see publication 525, taxable and nontaxable income. Web the specific tax. In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. You cannot report a change of earnings online. A drawing account is used primarily for businesses that are taxed. Web a drawing account is an accounting record maintained to track money and other assets withdrawn from a business. How much money depends on where you live, so look up what percentage of your income you'll owe. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $693,750 for married couples filing jointly. The company pays tax on it's net profit after it's paid you a shareholder salary. Web if the amount on line 5 is $100,000 or more, use the tax computation worksheet 14. Web there are seven federal income tax rates in 2023: The tool is designed for taxpayers who were u.s. Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows; California tops the list with the highest income tax rates in the country; A shareholder's salary is your share of the company's profits for work you do in the business. Web because the majority of your income is untaxed, you are going to want to set aside a percentage of your gross income so that you're not slammed all at once when april rolls around. You cannot report a change of earnings online. Drawings is money you borrow from the company. Avoiding unrelated business income tax;. Web at the end of the year, your taxable income would be $40,000 — the profits from the business, which your draws won’t reduce. An owner’s draw is not taxable on the business’s income. Web if you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away.

Tax Illustration Vector Vector Art & Graphics

Tax Vector Art Vector Art & Graphics

Woman taxes bills pencil stock illustration. Illustration of figures

Artistic drawing of 1040 individual tax Vector Image

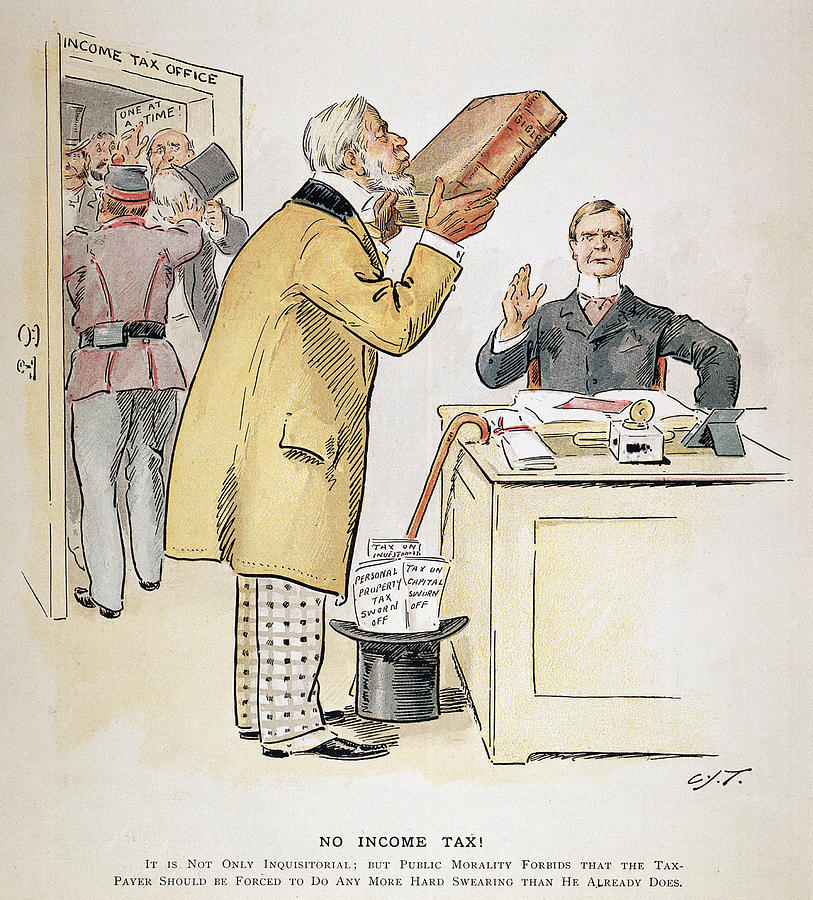

Tax Cartoon, 1894 Painting by Granger Pixels

![]()

icono de impuestos. Doodle dibujado a mano o estilo de icono de

Tax. Cute cartoon doodle illustration. 629013 Vector Art at Vecteezy

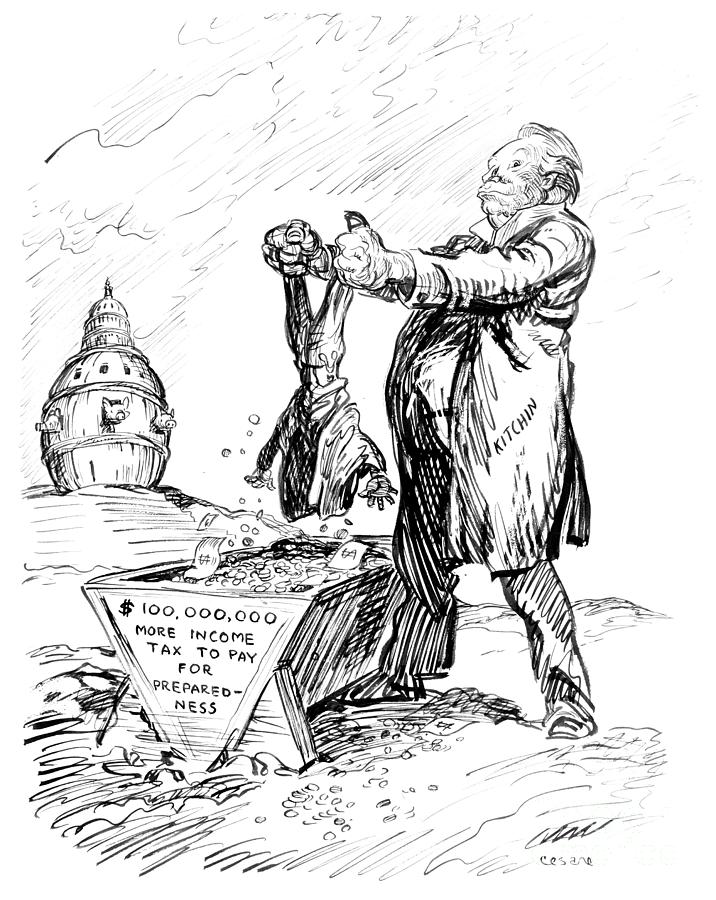

Tax Cartoon, c1915 Drawing by Oscar Edward Cesare Fine Art America

Tax Doodle Stock Illustration Download Image Now iStock

I dug up this tax drawing from 4 years ago, when I was studying for

Web Do You Have To Pay Taxes On Owner’s Draw?

Web The Federal Government Uses A Progressive Tax System, Which Means How Much Income Tax You Pay As An Individual Or A Couple Depends On How Much Taxable Income You Earn;

It's A Way For Them To Pay Themselves Instead Of Taking A Salary.

Web A Drawing Account Is An Accounting Record Maintained To Track Money And Other Assets Withdrawn From A Business By Its Owners.

Related Post: