Non Recoverable Draw Example

Non Recoverable Draw Example - You give the draw to an employee, but you don’t plan for the employee to earn enough in commissions to pay for the draw. Web nonrecoverable draws a nonrecoverable draw is a payment you don’t expect to gain back. The salesperson gets to keep the draw amount. Web a payment to a commissioned sales employee as an advance or loan against future, unearned commissions. Web draws are common in incentive plans. Think of itp as a guaranteed minimum commission payment. Web recoverable draw example. This is often used for new employees getting started or to cover times when work is slow, such as vacation periods or seasoned business cycles. Web payroll december 12, 2022 for sales positions, paychecks are often determined by commission. Here’s what that would look like in practice: Web recoverable draw example. Web in this example of a recoverable draw, let’s pretend this is the pay for an established ae. Both types of draw against commission will allow for better retention and a lower turnover as more salespeople feel. Therefore, the right commission structure is crucial for attracting and retaining qualified sales reps while protecting the employer’s financial. The company has instituted a draw amount of $2,000.00 to offer some stability for reps during seasonal low periods. Both types of draw against commission will allow for better retention and a lower turnover as more salespeople feel. Web in this example of a recoverable draw, let’s pretend this is the pay for an established ae. A draw against commission. Web a payment to a commissioned sales employee as an advance or loan against future, unearned commissions. Web recoverable draw example. The salesperson gets to keep the draw amount. Whenever ying makes $2000 in commissioner next month, she will be paid the full $2000 within earn but nothing from of. Web nonrecoverable draws a nonrecoverable draw is a payment you. If ying makes $2000 in commission next month, they will be paid the full $2000 in commission but nothing from the draw. Therefore, the right commission structure is crucial for attracting and retaining qualified sales reps while protecting the employer’s financial interests. Here’s what that would look like in practice: The company has instituted a draw amount of $2,000.00 to. 22 $1,500 $1,000 <$500> $300. This means that the salesperson is guaranteed to receive $1,000 per month, regardless of how much they make in commissions. By the end of this period, john earns a commission of $2000 from his sales. This is often used for new employees getting started or to cover times when work is slow, such as vacation. Brian sells $100,000 of products and is entitled to receive $20,000 in commissions. If ying makes $2000 in commission next month, they will be paid the full $2000 in commission but nothing from the draw. The rep typically gets to keep their advance, but this may spell an end to future draws. The salesperson gets to keep the draw amount.. The company has instituted a draw amount of $2,000.00 to offer some stability for reps during seasonal low periods. His employer sets his draw at $3000 at the beginning of the pay period. Web payroll december 12, 2022 for sales positions, paychecks are often determined by commission. This is often used for new employees getting started or to cover times. Whenever ying makes $2000 in commissioner next month, she will be paid the full $2000 within earn but nothing from of. The company has instituted a draw amount of $2,000.00 to offer some stability for reps during seasonal low periods. Web for example, imagine a sales rep is eligible for a $1,500 recoverable draw for the pay period, and at. Web payroll december 12, 2022 for sales positions, paychecks are often determined by commission. Sales is synonymic from allowances, which are the key component included yours sales compensation plan. Think of itp as a guaranteed minimum commission payment. His employer sets his draw at $3000 at the beginning of the pay period. Therefore, the right commission structure is crucial for. Web in this example of a recoverable draw, let’s pretend this is the pay for an established ae. sales commission draw example Both types of draw against commission will allow for better retention and a lower turnover as more salespeople feel. Web recoverable draw example. Web you might use nonrecoverable draw programs for certain lengths of time, like. Consider john, a sales rep with a recoverable draw agreement. Even if the employee doesn’t earn enough in commissions to cover the draw, you don’t hold the uncovered amount as the employee’s. Sales is synonymic from allowances, which are the key component included yours sales compensation plan. Therefore, the right commission structure is crucial for attracting and retaining qualified sales reps while protecting the employer’s financial interests. His employer sets his draw at $3000 at the beginning of the pay period. If ying makes $2000 in commission next month, they will be paid the full $2000 in commission but nothing from the draw. Whenever ying makes $2000 in commissioner next month, she will be paid the full $2000 within earn but nothing from of. They are usually paid as a goodwill gesture by the company during certain periods of sales uncertainty and also to. Web for example, imagine a sales rep is eligible for a $1,500 recoverable draw for the pay period, and at the end of the period they end up earning $500 in commissions. You give the draw to an employee, but you don’t plan for the employee to earn enough in commissions to pay for the draw. Web nonrecoverable draws a nonrecoverable draw is a payment you don’t expect to gain back. At payout, the rep earns the $500 in commissions plus $1,000 from the set draw allowance—for a total of $1,500. Brian sells $100,000 of products and is entitled to receive $20,000 in commissions. The company has instituted a draw amount of $2,000.00 to offer some stability for reps during seasonal low periods. The rep typically gets to keep their advance, but this may spell an end to future draws. 22 $1,500 $1,000 <$500> $300.

How to use a NonRecoverable Draw Against Commission in Sales

The Ultimate Guide to NonRecoverable Draw by Kennect

NonRecoverable Draw Spiff

NonRecoverable Draw Spiff

non recoverable draw language Shirleen Burroughs

non recoverable draw language Dara Pack

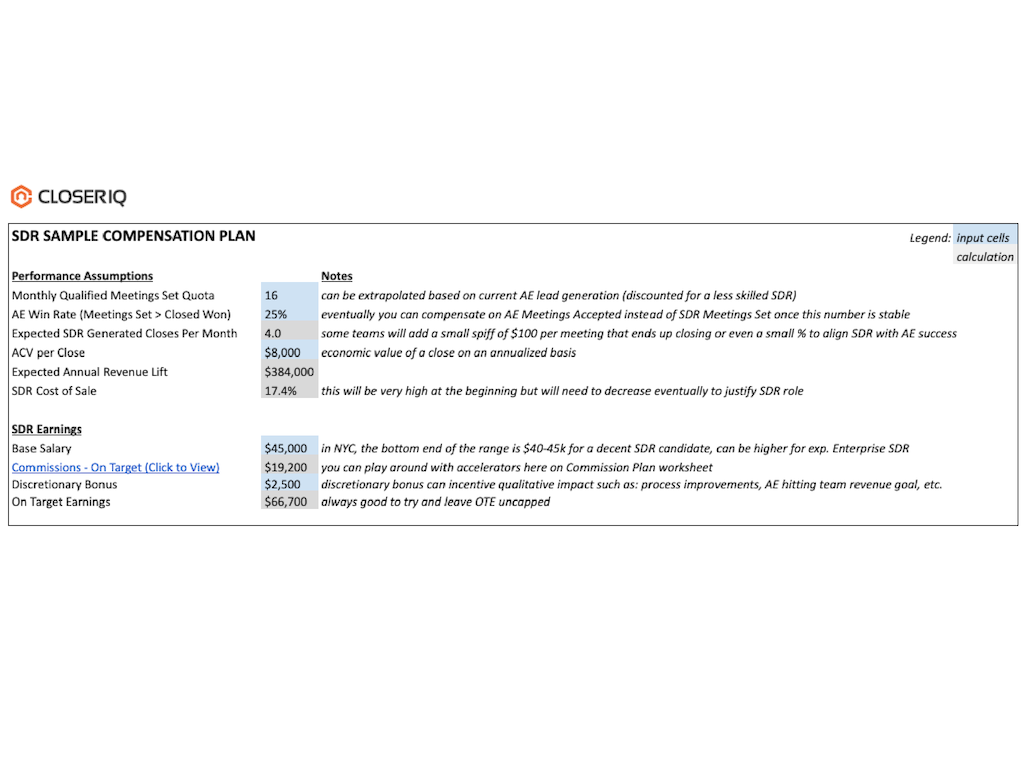

Effective AND Fair Sales Compensation Plan Blueprints [With Examples

NonRecoverable Draw Spiff

Recoverable and NonRecoverable Draws » Forma.ai

What Is Non Recoverable Draw Offer Letter?

Think Of Itp As A Guaranteed Minimum Commission Payment.

The Salesperson Gets To Keep The Draw Amount.

Web You Might Use Nonrecoverable Draw Programs For Certain Lengths Of Time, Like The First Six Months To A Year Of Employment, For Example, And Then Switch To A Recoverable Draw Against Commission Structure.

This Is Often Used For New Employees Getting Started Or To Cover Times When Work Is Slow, Such As Vacation Periods Or Seasoned Business Cycles.

Related Post: