Owner's Draw Quickbooks

Owner's Draw Quickbooks - An owner’s draw is the process in which a business owner takes funds out of their account for their personal use. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. This article describes how to. Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their. Web owner's draw vs payroll salary: A complete quickbooks training free course! Web frequently asked questions how do i record the owner’s draw in quickbooks online? To record the owner’s draw in quickbooks online, follow these steps: Business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply withdraw. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. In the pay to the order of field, enter your name. Web guide to set. Web guide to set up owner’s draw in quickbooks desktop you need to turn on the quickbooks desktop and hit on the “ list ” option now, choose the “ chart of. Go to the banking menu and select write checks. This article describes how to. Web 1 2 3 4 5 6 7 8 9 share 1.3k views 1. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web this guide will walk you through recording an owner’s draw in quickbooks desktop, making maintaining an accurate and precise record of. Web this guide will walk you through recording an owner’s draw in quickbooks desktop, making maintaining an accurate and precise record of your business finances more. From the sales tax owed list, select the tax agency you're recording the payment for, then select record tax payment. Typically this would be a sole proprietorship or llc where the business and the. In the account field, select owner’s equity from the drop. Typically this would be a sole proprietorship or llc where the business and the owner are. Web share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. Business owners often use the company’s bank and credit card accounts to pay personal. Web frequently asked questions how do i record the owner’s draw in quickbooks online? Web what is an owner’s draw account? An owner's draw account is an equity account used by. Business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply withdraw. Web learn more about owner's draw vs payroll salary. Web guide to set up owner’s draw in quickbooks desktop you need to turn on the quickbooks desktop and hit on the “ list ” option now, choose the “ chart of. This article describes how to. Odoo.com has been visited by 100k+ users in the past month An owner’s draw is the process in which a business owner takes. Web owner's draw vs payroll salary: If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. This article describes how to. Gusto.com has been visited by 100k+ users in the past month An owner’s draw is the process in which a business owner takes funds out of their account for their. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their. Web 1 2 3 4 5 6 7 8 9 share 1.3k views 1 year ago quickbooks desktop pro 2022 training tutorial: Web 1.3k views 15 hours ago. Web how to complete. In the pay to the order of field, enter your name. An owner's draw account is an equity account used by. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their. Business owners often use the company’s bank and credit card accounts. Don't forget to like and subscribe. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Gusto.com has been visited by 100k+ users in the past month In the pay to the order of field, enter your name. Web this guide will walk you through recording an owner’s draw in quickbooks desktop, making maintaining an accurate and precise record of your business finances more. Web frequently asked questions how do i record the owner’s draw in quickbooks online? A complete quickbooks training free course! Web 1.3k views 15 hours ago. Odoo.com has been visited by 100k+ users in the past month Web learn how to pay an owner of a sole proprietor business in quickbooks online. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. Business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply withdraw. Go to the banking menu and select write checks. From the sales tax owed list, select the tax agency you're recording the payment for, then select record tax payment.how to take an owner's draw in quickbooks Masako Arndt

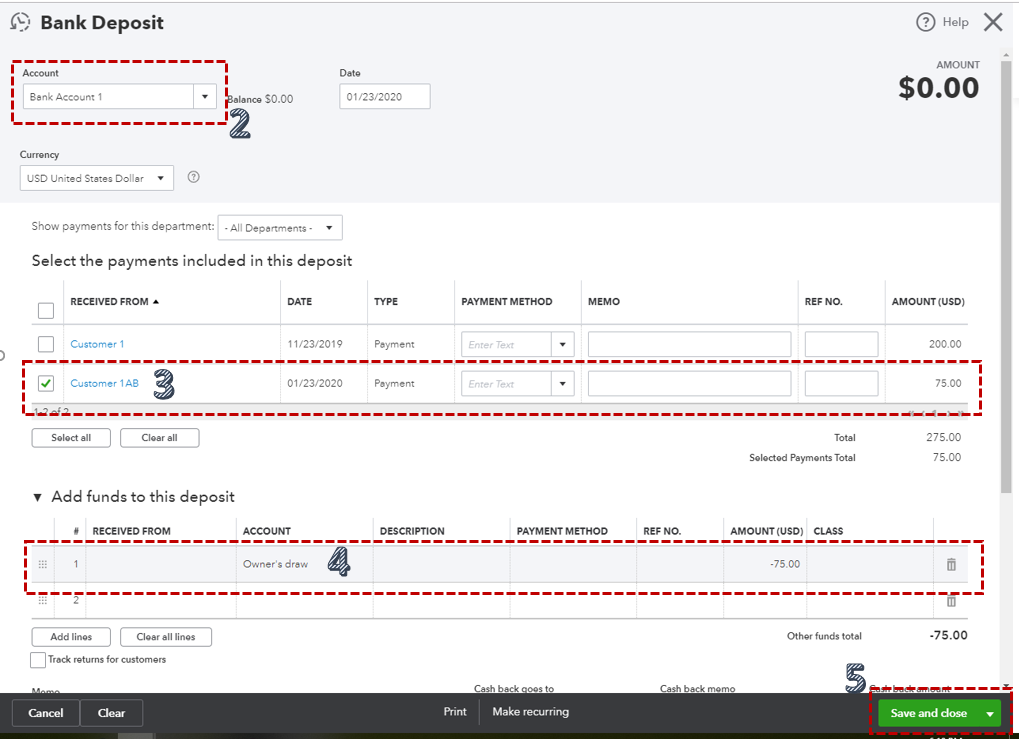

How to pay invoices using owner's draw? QuickBooks Community

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

How to record owner's draw in QuickBooks Online Scribe

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How to Record Owner's Equity Draws in QuickBooks Online YouTube

Owner Draw Report Quickbooks

Web Learn More About Owner's Draw Vs Payroll Salary And How To Pay Yourself As A Small Business Owner:

Web What Is An Owner’s Draw Account?

Typically This Would Be A Sole Proprietorship Or Llc Where The Business And The Owner Are.

In The Account Field, Select Owner’s Equity From The Drop.

Related Post: