Quickbooks Owner Draw

Quickbooks Owner Draw - Typically this would be a sole proprietorship or llc where the business and the owner. Web click sales tax. Web draws are pretty straightforward when 1) your company is a sole proprietorship, a partnership, or an llc that is structured for tax purposes as either of. In the account field, select owner’s equity from the drop. Go to the banking menu and select write checks. Web an owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. How does owner's draw work? Web 164 share 10k views 1 year ago an owner’s draw is when an owner takes money out of the business. This article describes how to. Web save the transaction to record the owner’s draw. Now hit on the “ chart of. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. Web an owner's draw account is an equity account used by. In the account field, select owner’s equity from the drop. Web here are few steps given to set up the owner’s draw in quickbooks online: Web an owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. How does owner's draw work? Web 164 share 10k views 1. Follow these steps to set up and pay the owner. Web an owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. In the account field, select owner’s equity from the drop. Web quickbooks and owner drawing simplified accounting 641 subscribers subscribe 77 share 10k views 6 years. Open the “ quickbooks online ” application and click on the “ gear ” sign. Web business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply withdraw money to pay themselves.let’s go. Typically this would be a sole proprietorship or llc where the business and the owner. Now hit on the. Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. In the pay to the order of field, enter your name. Web click sales tax. Do i need to create a separate account for the owner’s draw in quickbooks online? Now hit on the. In the pay to the order of field, enter your name. How does owner's draw work? Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. Web draws are pretty straightforward when 1) your company is a sole proprietorship, a partnership, or an llc that is structured for tax purposes as either of. Web. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper. 5/5 (50 reviews) Web any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet. From the sales tax owed list, select the tax agency you're recording the payment for,. Do i need to create a separate account for the owner’s draw in quickbooks online? How does owner's draw work? 1) create each owner or partner as a vendor/supplier: Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. In the pay to the. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. How does owner's draw work? In the account field, select owner’s equity from the drop. Business owners might use a draw for. Web the ad’s focus on the small business owner shifts the attention off the field and encourages viewers to cast aside preconceived. Web here are few steps given to set up the owner’s draw in quickbooks online: 5/5 (50 reviews) A separate account, such as an owner’s. Open the “ quickbooks online ” application and click on the “ gear ” sign. Web the ad’s focus on the small business owner shifts the attention off the field and encourages viewers to cast. Web save the transaction to record the owner’s draw. Web what is owner's draw in quickbooks? Web an owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper. How does owner's draw work? 1) create each owner or partner as a vendor/supplier: Follow these steps to set up and pay the owner. Do i need to create a separate account for the owner’s draw in quickbooks online? Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. 5/5 (50 reviews) Open the “ quickbooks online ” application and click on the “ gear ” sign. Web click sales tax. Now hit on the “ chart of. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. Web owner's draw vs payroll salary: In the account field, select owner’s equity from the drop.Owner Draw Report Quickbooks

how to take an owner's draw in quickbooks Masako Arndt

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

Owners draw QuickBooks Desktop Setup, Record & Pay Online

Quickbooks Owner Draws & Contributions YouTube

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Typically This Would Be A Sole Proprietorship Or Llc Where The Business And The Owner.

From The Sales Tax Owed List, Select The Tax Agency You're Recording The Payment For, Then Select Record Tax Payment.

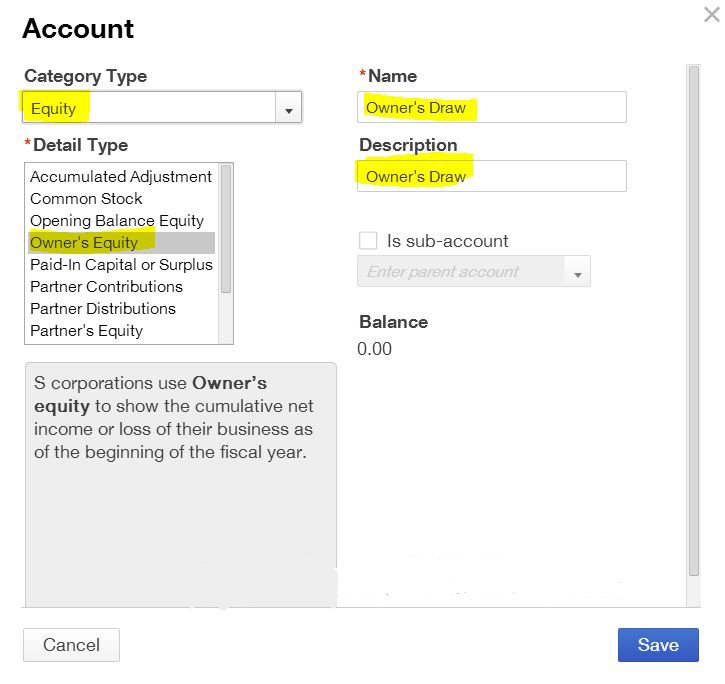

Web Here Are Few Steps Given To Set Up The Owner’s Draw In Quickbooks Online:

Web 164 Share 10K Views 1 Year Ago An Owner’s Draw Is When An Owner Takes Money Out Of The Business.

Related Post: