Quickbooks Owners Draw

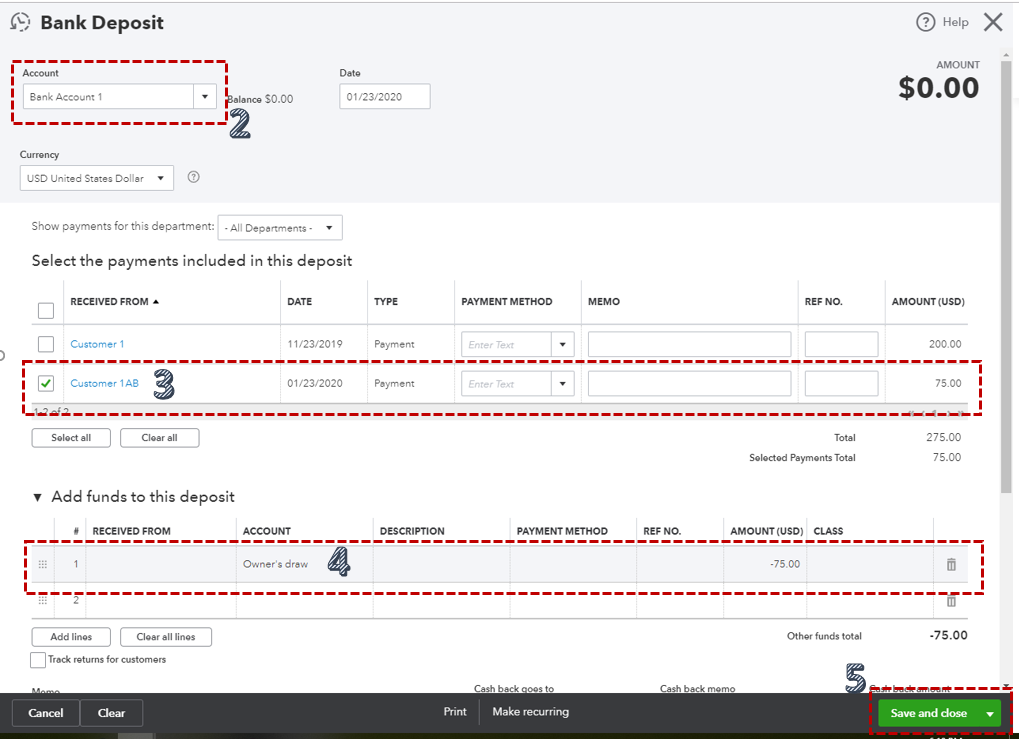

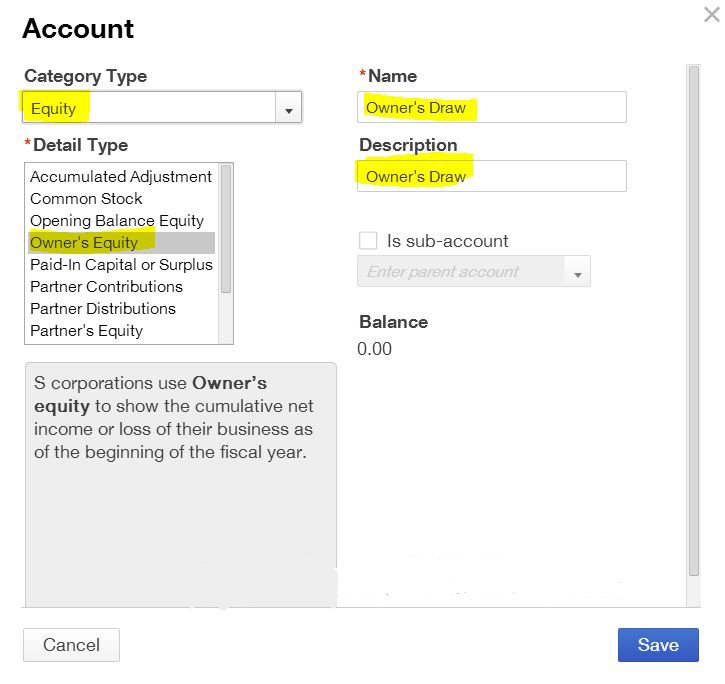

Quickbooks Owners Draw - How to pay yourself as a business owner. Web additionally, 76% of gen z small business owners and 80% of millennial small business owners want to hire in the new year compared to just 58% of gen x and baby boomers. Then, add the owners draw account as a negative amount under the add funds to this deposit section. If you're unable to edit the amount on this screen, in some cases. Type the name of the owner's draw account in the search box. Click create ( + ), then click check (under vendors ). For a company taxed as a sole proprietor or partnership, i recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership) An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. A complete quickbooks training free course! When you put money in the business you also use an equity account. Oc is the total of your contributions plus your retained earnings minus your draws. Those 3 accounts should be closed to oc at year. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. When you put money in the business you also use an equity account.. In the memo field, you can enter something like “owner’s draw for march.” 6. Web an owner's draw is an account where the owner takes the money out of the business. Owners draw is the expense (reason) for the check. View solution in original post. If you're unable to edit the amount on this screen, in some cases. Go to chart of accounts. Web 1 2 3 4 5 6 7 8 9 share 1.3k views 1 year ago quickbooks desktop pro 2022 training tutorial: For a company taxed as a sole proprietor or partnership, i recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership) Owners draw is the expense. Web the best way to do it would be to go back and change the expense account from owner's personal expenses to owner's draw (equity account) for each transaction if there aren't a prohibitively high number of them. Those 3 accounts should be closed to oc at year. Typically this would be a sole. Web how to complete an owner's. Quickbooks will randomly suggest a method to record a downloaded transaction. I'm happy to provide details about recording an owner's draw from a downloaded transaction. Web how can i run an 'owners draw' report to see the total drawn? Typically this would be a sole. As always, i suggest reaching out to your accountant on the best way to handle. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Web setting up owner's draw in quickbooks online. Web let me share some ways to record payments to owners draw in quickbooks online. Draws can happen at regular intervals or when needed. Web owner draw is an. Web an owner's draw is an account where the owner takes the money out of the business. Web learn how to pay an owner of a sole proprietor business in quickbooks online. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Enter the name, and the. Go to accounting on the left menu. How to pay yourself as a business owner. Web to pay back your account using an owner's draw in quickbooks, follow these steps: A complete quickbooks training free course! To write a check from an owner's equity account: Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. Use your gear ( ⚙️) icon. Oc is the total of your contributions. A complete quickbooks training free course! As always, i suggest reaching out to your accountant on the best way to handle this. Type the name of the owner's draw account in the search box. Go to chart of accounts. When you write a check to yourself, that is an owner draw. Web an owner's draw is an account where the owner takes the money out of the business. Web additionally, 76% of gen z small business owners and 80% of millennial small business owners want to hire in the new year compared to just 58% of gen x and baby boomers. Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. If you work as a sole proprietor, your compensation would typically come as an owner's draw rather than a regular paycheck processed through payroll. Locate your opening balance entry, then choose it. How to pay yourself as a business owner. Owners draw is the expense (reason) for the check. First, record the payment to the undeposited funds then deposit it to your bank account. Go to chart of accounts. July 21, 2020 04:23 am. Typically this would be a sole. Find the account, go it its action column and click view register. In the pay to the order of field, enter your name. Type the name of the owner's draw account in the search box. If you're unable to edit the amount on this screen, in some cases. Go to the banking menu and select write checks.

Quickbooks Owner Draws & Contributions YouTube

Owner Draw Report Quickbooks

how to take an owner's draw in quickbooks Masako Arndt

Owners draw QuickBooks Desktop Setup, Record & Pay Online

How to pay invoices using owner's draw? QuickBooks Community

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

How to record an Owner's Draw The YarnyBookkeeper

how to take an owner's draw in quickbooks Masako Arndt

How to Record Owner’s Draw in QuickBooks Desktop

Choose The Bank Account Where Your Money Will Be Withdrawn.

Web Quickbooks And Owner Drawing Simplified Accounting 641 Subscribers Subscribe 77 Share 10K Views 6 Years Ago #Quickbooks #Bookkeeping #Cashmanagement #Quickbooks #Bookkeeping #Cashmanagement.

An Owner’s Draw Is When An Owner Takes Money Out Of The Business.

Enter The Amount Of The Draw In The Amount Field.

Related Post: